Top Medicare Supplement Insurance in California:

Plans & Benefits

When navigating the Medicare landscape in California, supplement insurance, commonly known as Medigap, plays a crucial role in filling the gaps left by Original Medicare. This type of insurance covers additional costs such as deductibles, copayments, and coinsurance that Medicare Parts A and B do not cover, ensuring more comprehensive health coverage and fewer out-of-pocket expenses.

In this guide, we'll explore the top Medigap plans available in California, highlighting their key benefits and how to choose the right plan for your healthcare needs.

Understanding Medigap in California

Medicare Supplement Insurance in California is standardized and regulated by the federal government, ensuring that each plan offers the same basic benefits regardless of the insurer.

However, costs can vary between providers, so it’s essential to compare not only the benefits but also the pricing and insurer reliability. Plans are labeled from A through N, with each plan offering a different combination of coverage.

Popular Medigap Plans in California

Plan F- Coverage:

Plan F offers the most comprehensive coverage, including Part B excess charges and foreign travel emergency healthcare.

- Eligibility: It is only available to those who became eligible for Medicare before January 1, 2020.

Plan G- Coverage:

Plan G covers everything Plan F does, except the Part B deductible. It is often favored for its extensive coverage and lower premiums compared to Plan F.

- Popularity: It has become one of the most popular plans since the phase-out of Plan F for new Medicare enrollees.

Plan N- Coverage:

Plan N offers a lower premium in exchange for a small copayment for doctor visits and emergency room visits that don’t result in an inpatient admission.

- Cost-effectiveness: It is considered a cost-effective option for those willing to pay minor out-of-pocket expenses.

Benefits of Medigap Plans

1. Out-of-Pocket Cost Management: Medigap plans help manage expenses not covered by Original Medicare, such as copayments, coinsurance, and deductibles.

2. Flexibility and Freedom: Most Medigap plans allow you to visit any doctor that accepts Medicare, which is particularly important in California, where access to a broad network of healthcare providers can vary significantly by location.

3. Predictable Costs: With Medigap, you pay a monthly premium, and the plan covers the rest of the approved charges, making healthcare costs more predictable and easier to budget.

4. Coverage During Travel: Many Medigap plans offer coverage for health emergencies when traveling abroad, which Original Medicare does not typically cover.

Choosing the Right Medigap Plan

When selecting a Medigap plan in California, consider the following:

- Healthcare Needs: Assess your typical health care usage to determine which plan covers the costs you’re most likely to incur.

- Budget: Consider how much you can afford to spend on premiums versus potential out-of-pocket costs.

- Plan Availability: Not all plans are available in every part of California, so it’s essential to check the availability in your specific area.

- Compare Insurers: Look beyond coverage and cost—consider insurer ratings for customer service and financial stability.

Conclusion

Medigap plans in California provide an important way to supplement your Medicare coverage. By understanding the different plans and their benefits, you can make an informed choice that best fits your health needs and financial situation. Always compare plans thoroughly to find the best rate and the most reliable insurance provider.

Need more help now?

Fill in the form and a licensed agent will contact you!

This is a solicitation for insurance. By filling out the above form you are agreeing for a licensed agent to contact you.

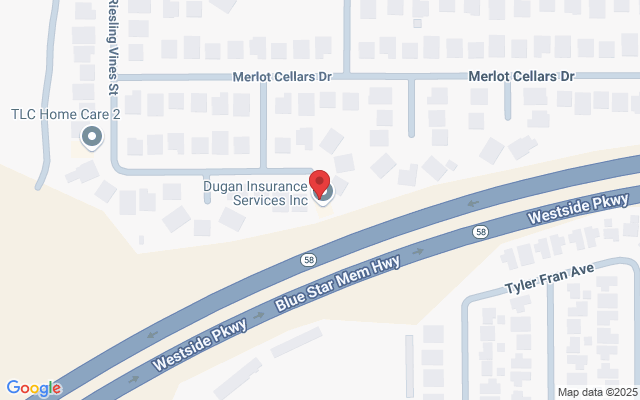

Find an Agent

These Happy Days are yours and mine Happy Days then one day he was shooting at some food.

Call Us for Any Questions

(800) 000-0000

Meet Our Agents

Consequuntur magni dolores ratione.

John Doe

Founder & CEO

John Doe

Region Leader

John Doe

Leader